Secure Onboarding, Simplified.

Leave it to ![]()

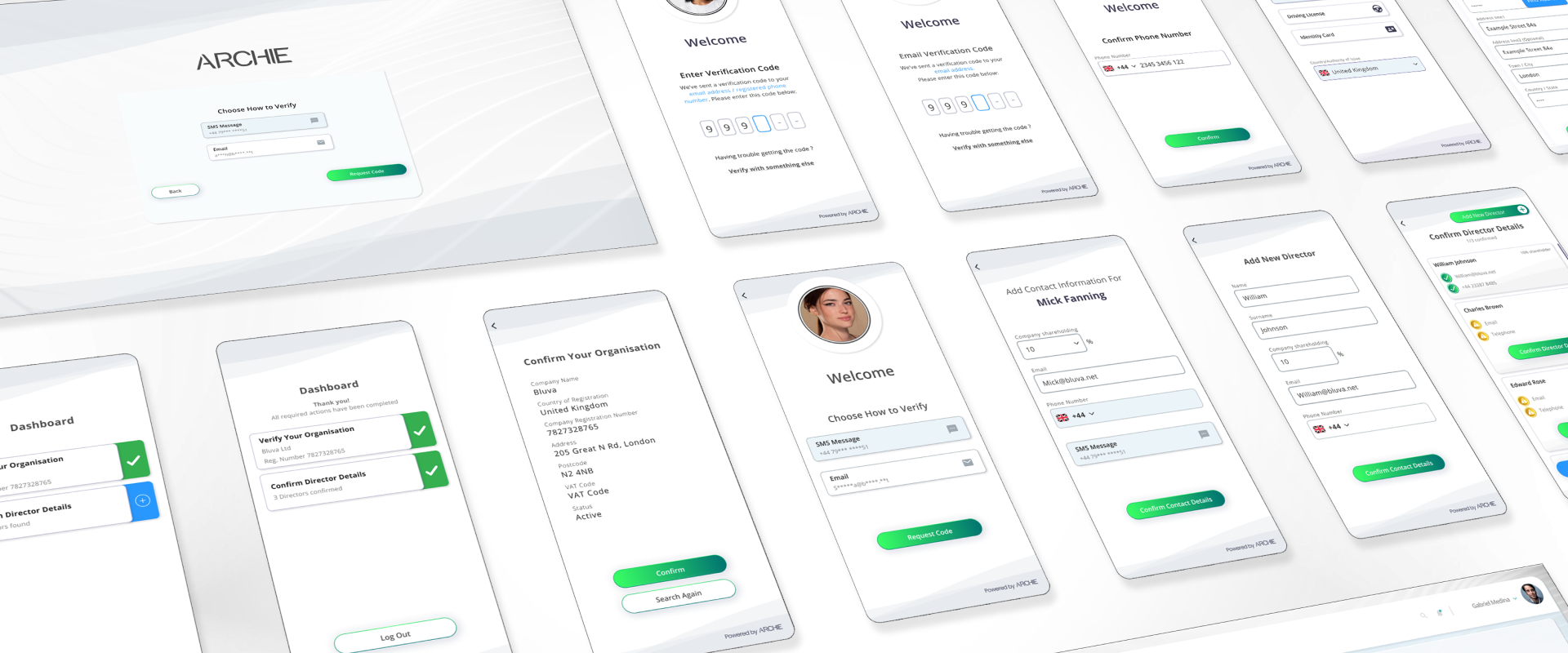

ARCHIE will chase the client and perform checks to produce confidence scores for your rapid approval

Setup & Integration

Setup: Configure Archie with

Collection Requirements

• Documents

• IDs

User Type

• Company & Directors)

• Consumer

Due Diligence

• Your questions and answers

External Checks

• Credit Agency

• Check Types

• Details

• Credit scores

• Politically Exposed Persons (PEP)

Repeat Checks

• Data points to re-check

• Timing its to re-check

Integration:

Archie will integrate via API with your

website, Apps, CRM or other platforms

Initiation

A KYC process can be initiated:

• Manually via Archie’s Compliance

• Automatically from your website, apps or other platforms via API

Data Collection

Leave it to Archie who will:

- Chase the client to collect Company & Director or Consumer details and supporting documentary evidence

- Perform Al powered liveness checks (on the user, uploaded IDs and the uploaded documents)

- Use Al to establish a document validity risk level

- Use Al to check document expiry dates

- Use Al to perfrom consistency checks accross all supplied data and uploads

- Performs optional £0 payment checks

Approval

Archie displays all collected data clearly

with Al powered confidence scores

Onboarding managers will inspect the

submission and click to:

- Re-request data

- Reject a process

- Approve a process

- Schedule a repeat check

- Trigger a request to collect due diligence data (optional)

Archie securely retains a detailed

audit trail

Modules

Compliance Module

- Up to 3 Manager Accounts

- Up to 500 KYC Processes / month

- 1 legal entity

- Unlimited Storage

- Forensic Audit Logs

KYC Process Fees

- Data & Documentation Collection

- AI powered liveness checks month

- Document validity risk level scores

- AI submission consistancy checks

- Optional AVS details check via banking institutions

Due Diligence Module

- Configurable Questions with Multiple Choice / Free Text Answers

- Document uploads

API Initiation

- Access to initiate Archie processes via API

- Integration Support

Enterprise API Access

- Endpoint access for deep integration within existing solutions

- Integration support

Credit Checks

- Verifies Company & Director or Consumer details

- Returns Company & Director or Consumer credit scores

AML Checks

- Company & Director or Consumer Sanctions checks

- Politically Exposed Persons (PEP) checks

Credit & AML Checks

- Credit Safe & TransUnion are built-in

- Archie works with most 3rd party AML & Credit checking agencies

- * Credit Check and AML Check Fees are subject to 3rd party minimum spends, volume and charges.